LOGIN

English

Google Ads PPC trends 2024: CPC analysis

Discover top cost-per-click trends of 2024. Why does CPC grows year on year and what seasonal changes affect paid advertising costs for marketing agency clients and online businesses.

We have asked our customers what industry they work in and analyzed the data processed by PPC Data Analytics of the Octoboard platform. Only clients that explicitly agreed to participate in the survey and shared their data for the purpose of this analysis were taken into consideration. Data was aggregated up and normalized across industries and time series. In order for an aggregated data point to be included in this study, it had to contain at least 30 data entries.

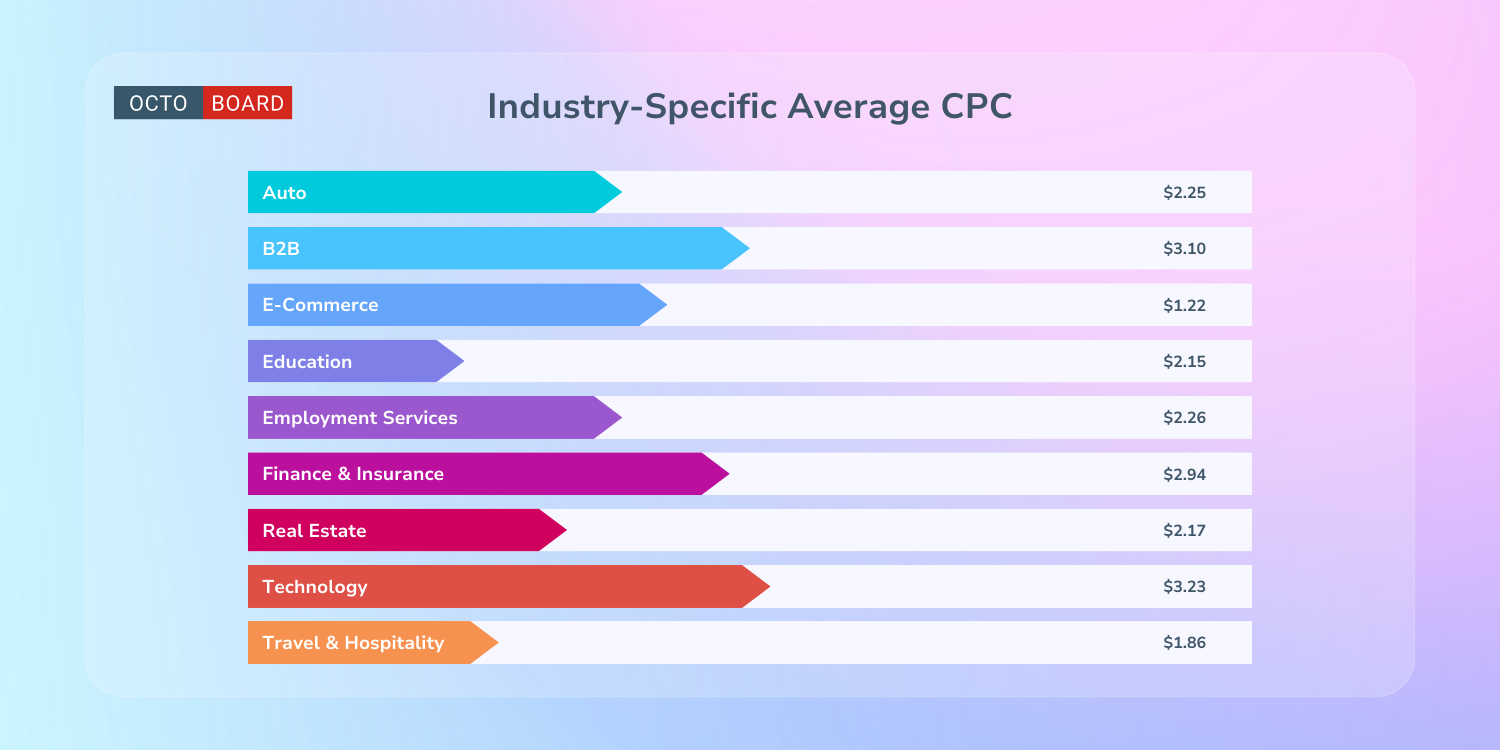

Based on the search results provided, here is a summary of the average cost-per-click (CPC) in Google Ads across different industries:

TABLE OF CONTENTS

- Key CPC trends in 2024

- Average Google Ads CPC by Industry in January-June 2024

- How has average CPC changed over the years

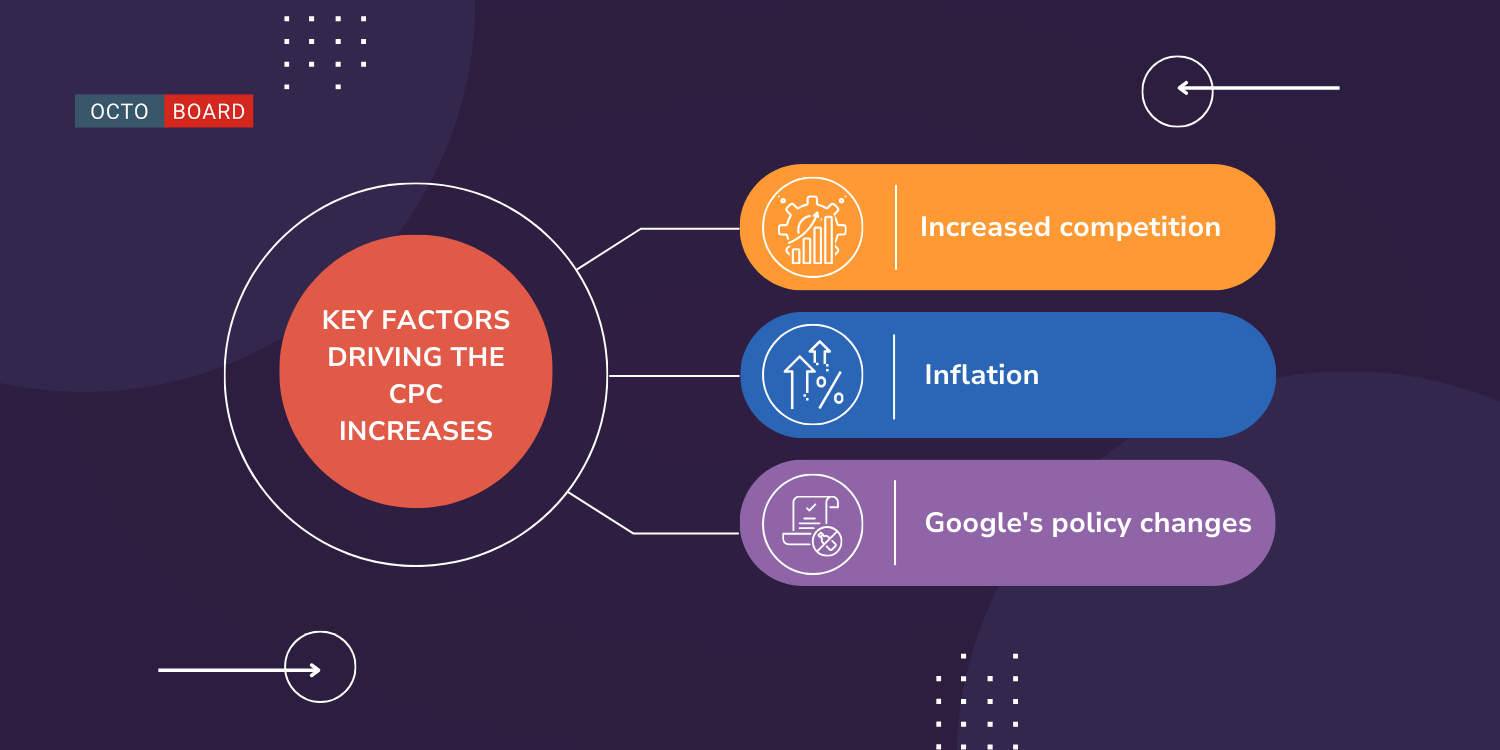

- Key factors driving the CPC increases

- How do seasonal trends affect average CPC

- Seasonal Fluctuations in CPC

- Factors Driving Seasonal CPC Changes

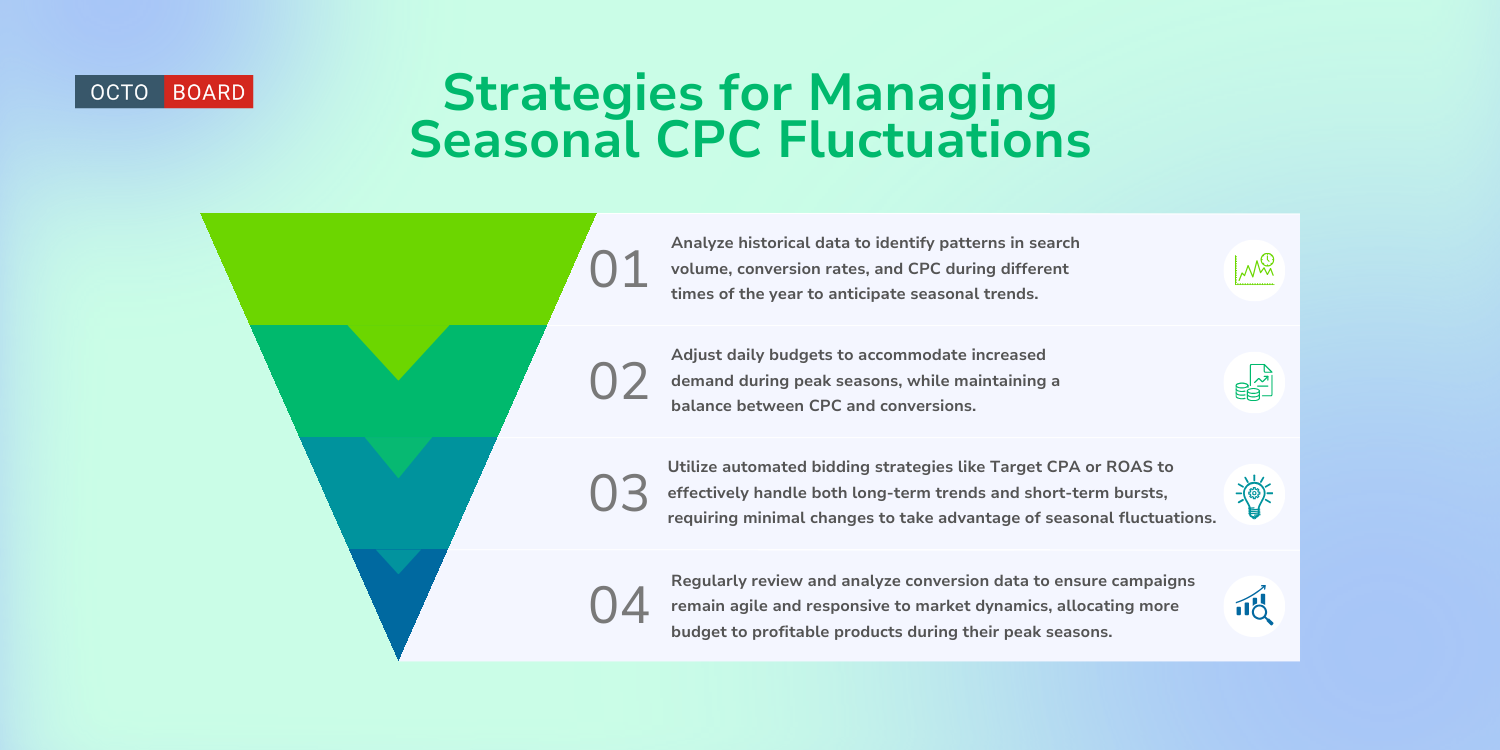

- Strategies for Managing Seasonal CPC Fluctuations

Overall Average CPC: $2.53

Industry-Specific Average CPC:

- Auto : $2.25

- B2B : $3.10

- E-Commerce : $1.22

- Education : $2.15

- Employment Services : $2.26

- Finance & Insurance : $2.94

- Real Estate : $2.17

- Technology : $3.23

- Travel & Hospitality : $1.86

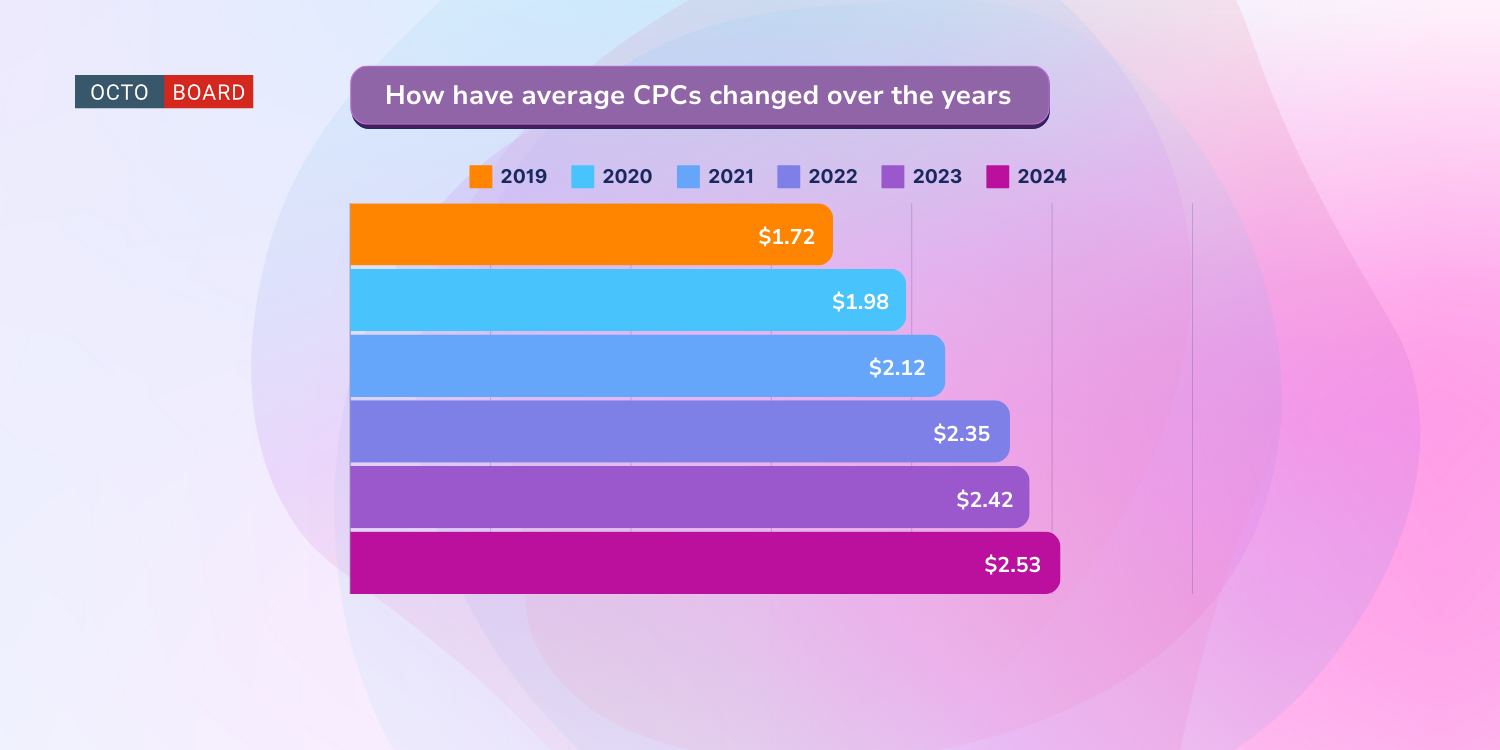

The average cost-per-click (CPC) in Google Ads has fluctuated over the years, with an overall upward trend:

- 2019: The average CPC was $1.72.

- 2020: The average CPC was $1.98.

- 2021: The average CPC was $2.12.

- 2022: The average CPC was $2.35.

- 2023: The average CPC was $2.42

- 2024: The average CPC rose to $2.53

These metrics have been combined by the Octoboard Paid advertising analytics platform and Octoboard PPC data transformation module.

- Increased competition: More advertisers are boosting their Google Ads spend, leading to higher competition and CPCs.

- Inflation: The economy and inflation are likely contributing to the rise in CPCs.

- Google's policy changes: Google making broad match the default match type could increase clicks that don't convert, driving up CPCs.

Seasonal trends can significantly impact average cost-per-click (CPC) in Google Ads across different industries:

- The holiday season, including Thanksgiving, Christmas, and New Year, often sees a surge in online shopping and advertising, intensifying competition and causing CPCs to rise, especially in ecommerce and retail.

- The back-to-school season can also lead to higher CPCs for businesses selling related products like stationery, computers, and children's clothing.

- Summers are generally slower months for many businesses, auto dealers are noticing a decline in revenue, potentially leading to lower CPCs during this period.

- Increased demand for ad space and higher click-through rates (CTRs) during peak seasons can cause a rise in CPCs as advertisers compete more aggressively.

- Conversion rates and sales also increase during holidays, justifying the rise in CPCs to maintain visibility, but advertisers must balance this with avoiding overspending.

- Competitor activity, such as major promotions or new product launches, can sway the market, either driving up CPCs due to increased interest or decreasing them due to heightened competition.

- Analyze historical data to identify patterns in search volume, conversion rates, and CPC during different times of the year to anticipate seasonal trends.

- Adjust daily budgets to accommodate increased demand during peak seasons, while maintaining a balance between CPC and conversions.

- Utilize automated bidding strategies like Target CPA or ROAS to effectively handle both long-term trends and short-term bursts, requiring minimal changes to take advantage of seasonal fluctuations.

- Regularly review and analyze conversion data to ensure campaigns remain agile and responsive to market dynamics, allocating more budget to profitable products during their peak seasons.

By understanding and leveraging the principles of seasonality, advertisers can optimize their Google Ads campaigns, ensuring they remain competitive and maximize their return on investment throughout the year.

Start using your cloud data to grow sales, save cost and retain clients GET OCTOBOARD FREE

GET OCTOBOARD FREE

How to enable cross-channel PPC analytics with Octoboard

Your marketing Data Hub

Power all your marketing analytics, reporting and data warehouse systems - from data aggregation and cleaning to data visualisation and exports.

Business features include

Your marketing Data Hub

Connect PPC data sources

Clean and transform data

Export to external systems

Secure Data Warehouse access

Automated reporting

White label client portal

ChatGPT data insights

YOU MAY ALSO LIKE

How to Use Web Analytics in 2025

Octoboard offers OpenAI/ChatGPT data insights, heatmaps (clickmaps, mousemove maps, scrollmaps), real-time dashboards and other features that help businesses use web analytics. We have asked some of the Octoboard customers about how they plan to use Octoboard Web Analytics in 2025.

Top 5 web analytics trends expected to dominate in 2025

Artificial intelligence and machine learning will revolutionize web analytics, enabling deeper insights into user behavior, trend identification, and predictive analytics. This post outlined key web analytics trends that Octoboard client see dominating in 2025.

Email Marketing trends 2024: benefits of hyper-personalization

Hyper-personalization in email marketing offers several key benefits that enhance both customer engagement and business performance. Octoboard Ecommerce Analytics customers shared their thoughts on how to use email personalisation in campaigns and ecommerce email automations.

Marketing Data AI Insights: New Business Strategies for 2024

AI technologies analyze consumer behaviors, preferences, and interactions across multiple touchpoints. AI provides marketers with actionable intelligence. Predictive modelling allows companies to anticipate future trends and customer needs. This article discusses AI capabilities and ways to add AI to your marketing data.